JLL Capital Markets explains how early entrants can gain first-mover advantage

CHICAGO, IL – The Coronavirus introduced a 90-day lull in new property offerings in the United States, but investors are ready to shift their capital off the sidelines and back into purchasing commercial real estate assets again.

There is a heightened focus from capital on defensive sectors, and the multi-housing sector is well-positioned to benefit from increased activity.

JLL’s Capital Markets experts, who carefully track investment transaction interests and trading probabilities, are preparing more than $9 billion of multi-housing assets that are being marketed or will hit the market in the next 30-45 days.

“We’ve seen an increase in the number of ‘broker opinions of value’ requests in the last 30 days as owners seek more visibility into asset values,” said Matthew Lawton, Executive Managing Director, Capital Markets, JLL Americas.

“We’re identifying the strongest multi-housing assets to put on the market to drive pricing in an opaque market.”

While the bid-ask spread may vary, previous cycles have shown that the early entrants into multi-housing can gain first mover advantage.

Multi-housing has become the most liquid asset class in the United States accounting for 37.6 percent of national transaction volume in 2019.

In the past two downturns, during a transaction volume trough, buy-side advantages favored investors who purchased ahead of rent increases.

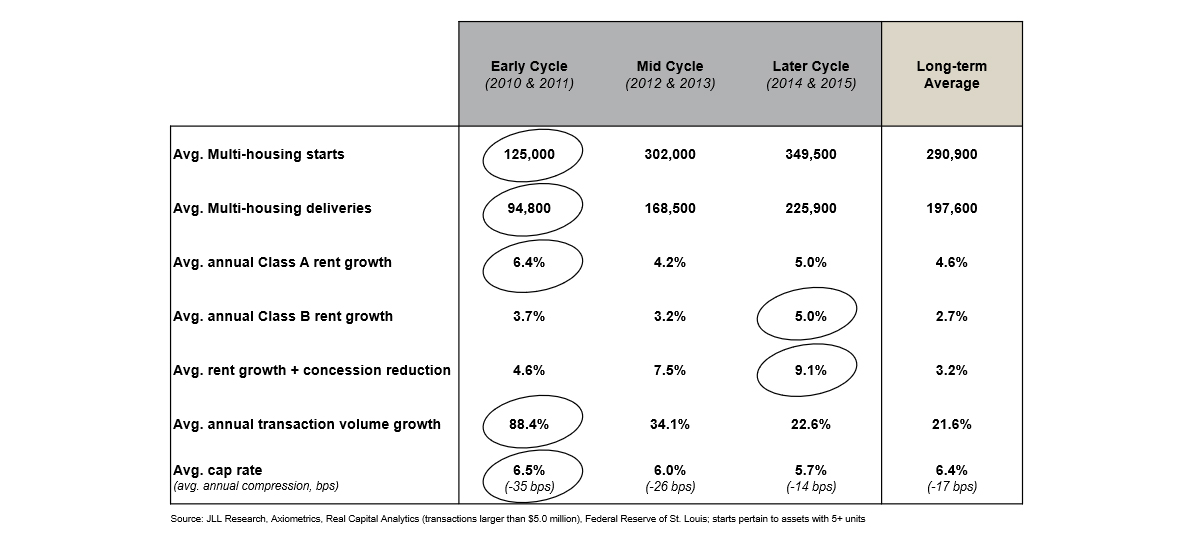

Elevated effective rent growth and diminished concession packages illustrate upside potential, as supply-side fundamentals are favorable in the early years of the recovery (chart 1).

“We’re seeing rent collections nationwide come in better than expected from renters,” added Lawton.

“That gives investors more confidence, and they are likely to use the next few months to get ahead and place capital and gain first-mover advantage, particularly given uncertainty related to the upcoming U.S. presidential election.”

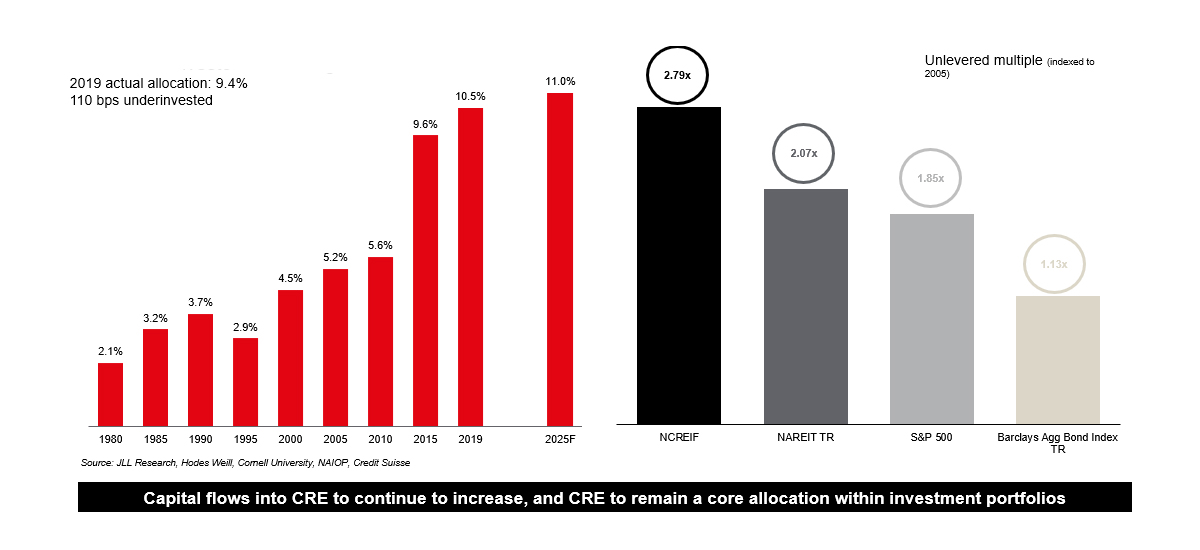

Commercial real estate continues to gain favor as a preferred asset class for institutional investment, with target allocations rising from 5.6% in 2010 to 10.5% in 2019. Even in the COVID-19 recessionary environment, JLL sees increased activity into real estate as the sector outperforms other asset classes (chart 2).

CONTACT:

Kimberly Steele

Senior Associate, Public Relations

JLL Capital Markets

9 Greenway Plaza, Suite 700

Houston, TX 77046

T +1 713 852 3420

M +1 832 244 9994

Senior Associate, Public Relations

JLL Capital Markets

9 Greenway Plaza, Suite 700

Houston, TX 77046

T +1 713 852 3420

M +1 832 244 9994

No comments:

Post a Comment